Embracing SAFe in Finance to become a Data-Driven Company

Embracing SAFe in Finance to become a Data-Driven Company

By Hao Li, iSPCT, ICAgile Enterprise Coach, Principal Consultant

Note: This article is part of the SAFe Beyond IT series, and it offers real-world Business Agility experiences in Operational Value Streams written and contributed by SAFe professionals.

Abstract

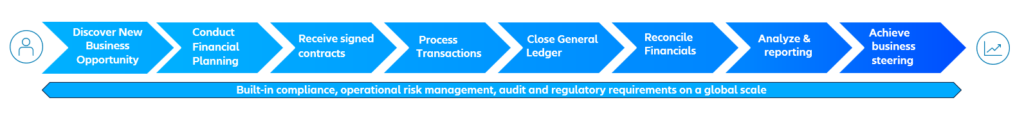

Finance in highly regulated organizations plays a vital role in steering strategic direction and driving operational excellence with high quality data insights, so that demands from internal and external customers can be met continuously. At the same time, finance often faces scarcity of talents, error-prone manual processes, data silos and data quality challenges with fragmented legacy applications. This makes it difficult to keep the lights on under very tight schedules while assuring compliance, risk and audit requirements.

This report summarizes a 5-year journey of transforming finance by adapting lean-agile principles of Scaled Agile Framework to achieve sustainable business agility at scale.

Context

After decades of global lines of businesses integration with increasingly volatile, fast-paced, and fragmented external market development, a decision to adopt Agile was reached due to following challenges:

- Financial Information integration was at risk due to different interfaces and capabilities of legacy processes and applications

- Lack of data harmonization resulting in data quality challenges and months of cycle time for new reports

- Increasing inability to close books on time

- Increasing demand from business partners for advanced data analytics

- Conflicting priorities creating delays in decision making

The sense of urgency of creating an Agile operating model to better serve our customers, employees and stakeholders was never higher.

Here’s what we had to achieve:

- A consolidated and harmonized single point of truth for information across all lines of business and regions across the globe

- A fully integrated, flexible platform for data analytics

- A solution that could fulfill current and future management and regulatory reporting requirements

- A high degree of automation of the financial closing process and reduced closing cycle times

- A delivery model focused on products and value streams rather than projects

In a nutshell, SAFe was adapted to grow an Agile culture and become a true data driven organization.

Actions

We realized that implementing SAFe would be an adventurous journey due to the following reasons:

- Our classical program/project management ways of working

- Our difficulty introducing market leading new technologies with limited experiences

- Our lack of in-house Agile experience

- Our teams were organized around functions, not value

We applied the SAFe implementation roadmap to guide us along this journey. It gave us a compass to effectively design an implementation that fit our context. We achieved success in 3 steps: involving Finance executives early, empowering cross-functional teams, and building quality into the Finance value stream.

1. Getting Started: Continuous Executive Engagement

The first step was to organize an executive workshop with the CFO, COO, and other top executives to introduce SAFe. This brought several initiatives, projects, and programs together and ensured the executives would be part of the journey. Soon afterwards, value stream and ART identification workshops were conducted with key stakeholders across finance to map out the finance value stream and understand the applications and capabilities required for building a new platform. The outcome of those workshops gave us a targeted strategy with a tangible implementation plan.

Leaders in finance decided to adapt their behaviors, shift away from day-to-day supervision, attend PI Planning as Business Owners, and join the System Demos. This gave teams the leadership support they would need to implement the change and deliver the most relevant business outcomes.

2. Implementing: Empowering and Enabling People

Finance is not a single piece of iron, there are different functional areas such as Financial Planning and Controlling, Billing and Collections, Risk Management, Audit, Treasury, and General Ledger Accounting. Finance professionals had great expertise and were truly respected in the organization, but most of them had never worked in agile before. And there was no one with Scrum Master or Product Owner experience.

To correct this, the transformation team rolled out dedicated training for every team member. They also dedicated time for a PI Planning dry-run to help them understand why and how to have a successful PI Planning event. This built cohesive, cross-functional finance teams and aligned them to common objectives.

Later, Product Owners from finance shifted across Agile Release Trains. This fluidity of resources allowed teams to devote time to activities where they could add the most value at any given time.

At first, we wondered if switching and changing POs was a good idea. However, it soon become clear that by exchanging knowledge and improving collaboration with colleagues in other business units, finance specialists could add value in those areas and grow professionally.

SAFe events such as PI Planning and ART Sync helped to ensure that teams raised issues and were transparent about progress. Colleagues could rapidly see results and recommend course corrections as needed.

There were Epic Owners deeply embedded in the team from finance, which created a close relationship between business and IT. These finance Epic Owners were empowered by leaders to drive decentralized decision-making and focus solutions on economic outcomes.

The Agile finance teams worked collaboratively, autonomously, and in alignment with business goals, which enhanced trust with senior management.

3. Built-in Quality: Shifting Audit, Compliance, and Risk Management Left

When the Agile Release Train was first launched, people were excited. The new way of working was engaging and created a sense of fulfillment. Most people would never go back to the old ways of managing change requests and fighting for the budget. However, after a few PIs quality challenges surfaced.

Teams realized that these requirements were not being managed in an Agile way and needed to improve the definitions of done, acceptance criteria, testing standards, and Kanban transition criteria. It took several iterations to evolve, but by distributing ownership of quality across the teams, we were able to shift audit, compliance, and risk management practices left, building expertise within each team, and improving delivery quality.

This was very different than traditional program management where a program or project manager is the one who takes responsibility for managing risk. Instead, everyone was responsible for building quality in. Further, during PI Planning, the ART would ROAM risks, including Audit and compliance. There no longer was a hierarchy to who managed quality, but collective responsibility across the ART, enabled by key experts and tools.

We consider SAFe a risk management framework in itself. The radical transparency that results from alignment among stakeholders, a clear PI plan, and distributed ownership allows risks to be surfaced and mitigated before they have an impact.

Takeaways

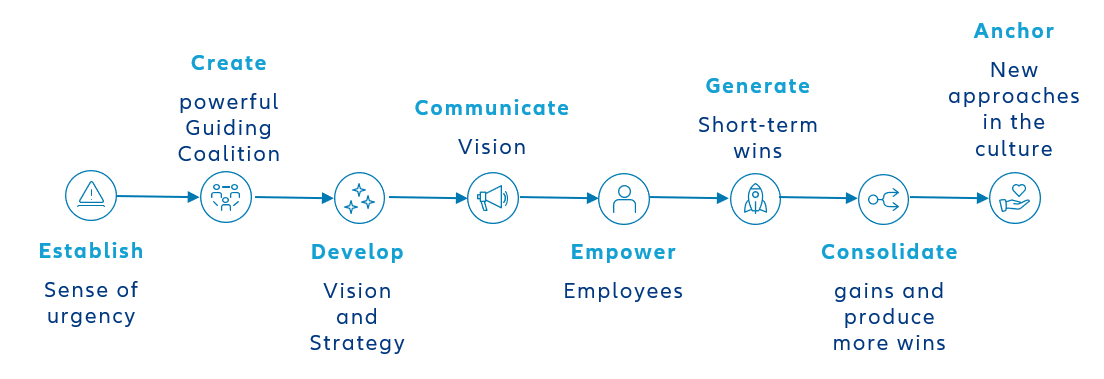

Don’t shortcut change management

Change management is deeply embedded in the SAFe implementation roadmap, inspired by John Kotter’s book “Leading Change”, through 4 decades of observations of countless leaders and organizations.

It was easy to lose track of change management over the 5 years. Several implementation approaches were experimented with, however the ones that followed the SAFe implementation roadmap were the most natural, reliable, engaging, and effective.

We didn’t choose a big bang change, but a phased approach. We launched the first Agile Release Train then inspected and adapted before the second one was launched half a year later. Looking back, those decisions have made profound impact on the organization.

Following Simon Sinek’s advice, start with “why” and don’t declare victory before the new culture emerges. Eventually, shared ownership, transparency, commitment, engagement, and pride of delivery will become the new normal.

Who is responsible for change management? Well, it’s everyone. Leadership, product management, and team members all must play their part.

Manage the system and lead people to create magic

Maximum capacity utilization was a traditional way of management at this organization. Waterfall projects started with as much work as possible and added more people late in the process. Since introducing SAFe, the focus gradually shifted from managing people towards managing the system—eliminating waste, reducing handovers, and aligning priorities.

Top executives now visit PI planning more often. They organize executive meetings in parallel to accelerate decision making, which used to take weeks. Product managers measure cost of delay by using WSJF. The ART holds a system demo every two weeks, even if it only takes 30 minutes, so that teams can get fast feedback from users.

To ensure teams make great contributions to the organization’s strategic objectives, leaders must communicate very clear focus and intent, lead with empathy, engage and empower knowledge workers, show consistent behavior, and be genuinely interested in what people do. When cross-functional agile teams have the ability to make decentralized decisions with clear direction, they unleash the power of innovation. This is how magic happens at work—making the impossible possible.

No two leaves are alike, but their patterns are similar

Last but not least, during this multi-year implementation, it was realized that SAFe not only serves development value streams but operational value streams as well. Although challenges may be different inside and outside IT, achieving customer centricity with speed and quality at scale through actionable planning and clear ownership is achievable in all areas of the business. Lean-Agile values and principles are context free while practices are context specific. Focus on identifying universal patterns and exploring techniques for implementing them in different business contexts.

It’s always ‘day 1’ of relentless improvement. Finance is no exception. Fortunately, we have now a proven compass to guide us through learning how to thrive in the digital age.