Updates to Lean Portfolio Management Competency and WSJF articles

Hi folks,

We have recently made some updates to SAFe Lean Portfolio Management, and we are committed to keeping you updated as the Framework evolves. Below are some highlights of the recent changes:

- The guidance for all ‘LPM Events’ has been moved to the article’s end, improving readability.

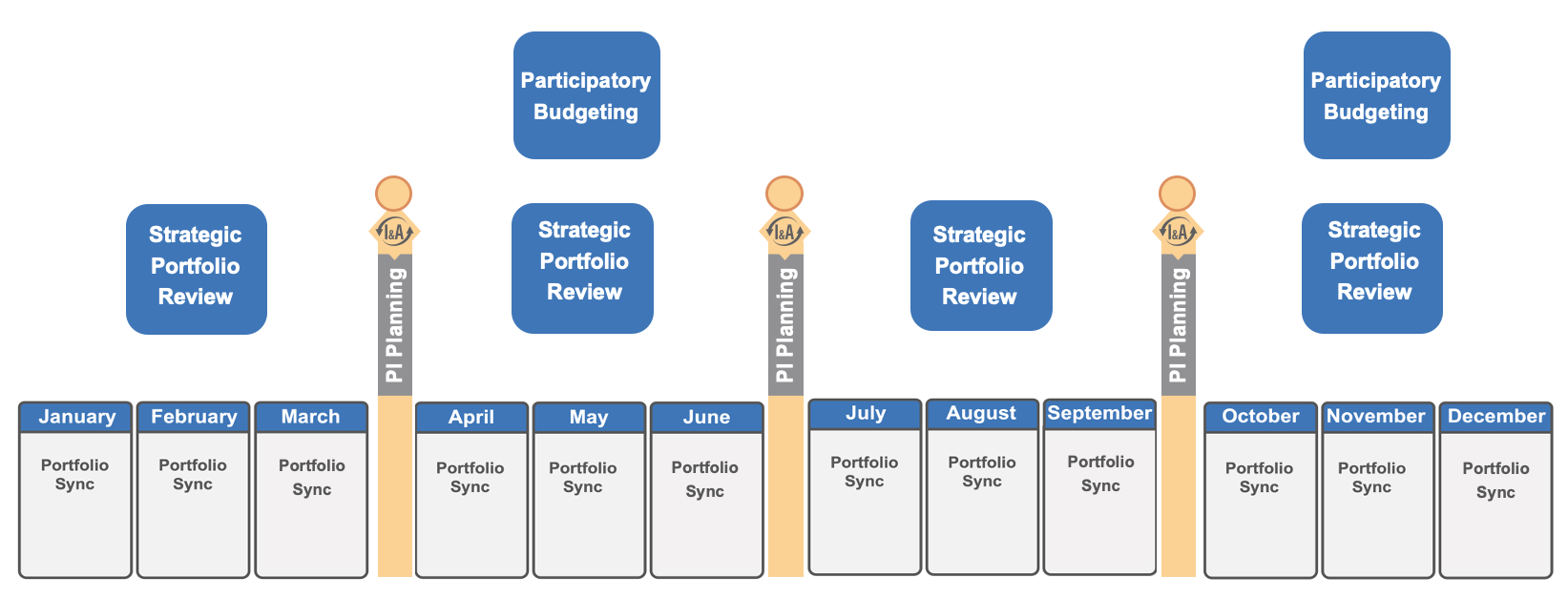

- Each event’s descriptions were improved, including adding two new graphics. The first figure below (Figure 1) illustrates the cadence of the three LPM events. The second figure (not shown) compares the purpose and typical topics discussed at the portfolio sync and strategic portfolio review.

Weighted Shortest Job First (WSJF) article:

The WSJF article has been updated to improve readability and includes new guidance for estimating Epics in actual monetary value as they make their way through the Portfolio Kanban system.

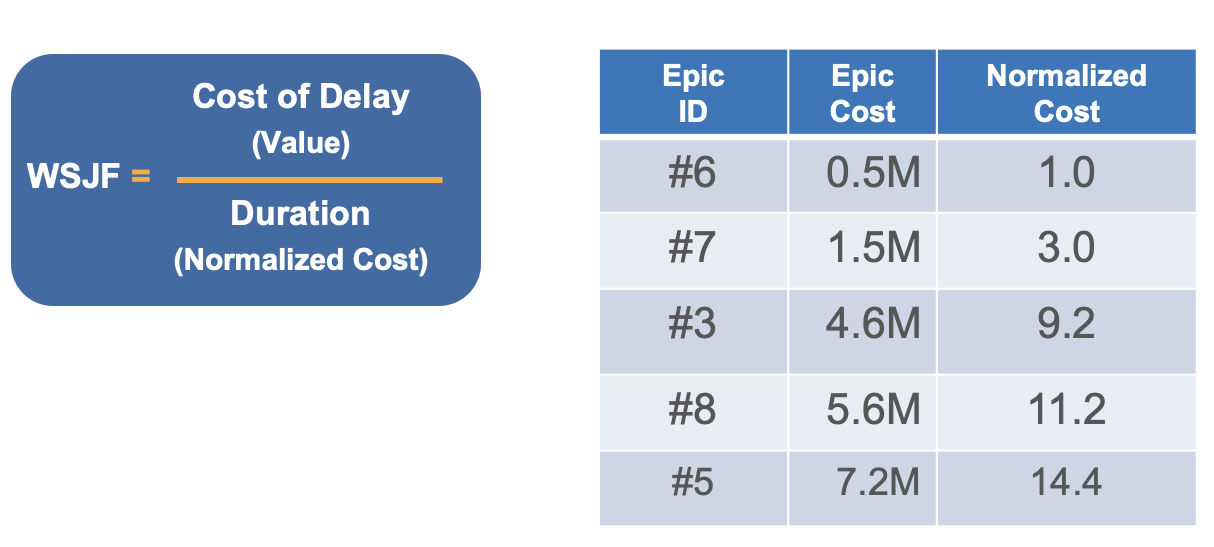

When estimated job costs are known, WSJF can be further refined by using it for the denominator. In this case, normalizing the cost of epics makes the math work out a lot easier.

To normalize cost, give the lowest estimated epic cost a ‘1.0,’ then divide the cost of subsequent epics by the lowest value (e.g., 1.5/ 0.5 = 3.0), as shown in Figure 1 below.

Stay SAFe,

—Richard Knaster

Frank Dörr

Hi Richard,

I don´t really get it. Are you serious about: When ACTUAL costs are known, WSJF can be further refined by using ESTIMATED costs for the denominator.

Cheers, Frank

Richard Knaster

Hey Frank,

Thanks for your feedback. I’ve fixed the blog posting and WSJF article. We are so fortunate to have such a caring community to find these errors and report them to us.

Good Catch!

Cheers,

Richard

Peter Jetter

IME it is helpful to acknowledge the Cone of Uncertainty. I made better experiences with sticking to geometric series (Fibonacci). Avoid illusion of precision, where there is little. Pick closest “Fibonacci” number. True for CoD/Business Values and “cost”. I propose to at least experiment with a few variants and choose the one that works best in your context.